|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Chapter 7 Bankruptcy in Michigan: What You Need to Know

Introduction to Chapter 7 Bankruptcy

Filing for Chapter 7 bankruptcy in Michigan can be a daunting process. This type of bankruptcy is designed to give individuals a fresh start by liquidating non-exempt assets to pay off creditors. It is crucial to understand the steps involved and the implications it has on your financial future.

Eligibility Criteria

Means Test

To qualify for Chapter 7 bankruptcy in Michigan, you must pass the chapter 7 bankruptcy means test calculator. This test determines whether your income is low enough to warrant debt discharge under Chapter 7.

Residency Requirements

Before filing, ensure you have lived in Michigan for at least 180 days. This residency is essential to file under the state's jurisdiction.

The Filing Process

Collecting Necessary Documentation

- Income statements for the last six months

- Recent tax returns

- Details of all debts and assets

Credit Counseling

Before filing, you must complete a credit counseling course from an approved agency. This is a mandatory step to proceed with your case.

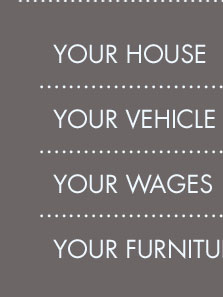

Exempt vs. Non-Exempt Assets

Understanding the difference between exempt and non-exempt assets can help you protect certain belongings during the liquidation process.

Exempt Assets

- Homestead exemptions

- Vehicle exemptions up to a certain value

- Personal belongings

Non-Exempt Assets

Non-exempt assets, such as luxury items or multiple properties, may be sold to repay creditors.

The Role of a Bankruptcy Trustee

Once you file, a bankruptcy trustee is appointed to oversee your case. The trustee's role is to review your documentation, liquidate non-exempt assets, and distribute proceeds to creditors.

Alternatives to Chapter 7 Bankruptcy

If Chapter 7 is not suitable, consider other options like Chapter 13 bankruptcy, which involves a repayment plan. For example, exploring chapter 7 bankruptcy massachusetts can provide insights into how different states manage similar cases.

FAQ

What debts are discharged under Chapter 7 bankruptcy?

Chapter 7 bankruptcy can discharge unsecured debts like credit card balances, medical bills, and personal loans. However, it does not discharge certain debts such as alimony, child support, and most student loans.

How long does the Chapter 7 process take?

The Chapter 7 process typically takes about four to six months from filing to discharge, assuming no complications arise during the proceedings.

Can I keep my car if I file for Chapter 7 bankruptcy?

Yes, you may keep your car if its value is within the state exemption limit or if you reaffirm the car loan and continue making payments.

By filing for bankruptcy in Michigan, the Chapter 7 gives you options to keep your home and property (if you are current on payments and within allowed equity ...

Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt.

Individual Checklist ; 12. Certificate of Budget and Credit Counseling Course, 14 days ; 13. Statement About Your Social Security Numbers (Official Form B121) ...

![]()